In the dynamic world of financial advisory, small firms often find themselves at a unique crossroads. They operate with the agility and personalized touch that clients crave, yet they must contend with the same stringent regulatory demands and competitive pressures as their larger counterparts, often with fewer resources. This makes the choice of a Financial Advisor CRM for Small Firms a pivotal decision, one that hinges not only on features and user-friendliness but critically on affordability and compliance. Navigating this intricate balance is paramount for sustainable growth and long-term client trust.

The Unique Operating Environment of Small Financial Advisory Firms

Small financial advisory firms, typically comprising a few advisors or even a solo practitioner, operate with distinct advantages and challenges. Their close-knit structure often fosters deeper client relationships, allowing for highly personalized service that can be difficult for larger institutions to replicate. However, this personalized approach also demands efficient management of client data, communications, and regulatory obligations, which can quickly become overwhelming without the right technological backbone. Unlike large enterprises with dedicated IT departments and substantial budgets, small firms must be resourceful, seeking solutions that provide enterprise-grade capabilities without the prohibitive price tag. Their operational efficiency directly impacts their profitability and capacity for growth, making every technological investment, particularly in client relationship management, a strategic decision.

The inherent limitations in staffing and budget mean that any new system implemented must offer an immediate return on investment, not just in terms of client satisfaction but also in operational savings and reduced administrative burden. This necessitates a CRM solution that is not overly complex to implement or maintain, and one that doesn’t require extensive, costly training. For these firms, the CRM isn’t merely a tool; it’s an extension of their team, automating routine tasks, ensuring consistent service delivery, and fundamentally supporting their business model. Therefore, understanding their unique context is the first step in appreciating the complexities of choosing the right Financial Advisor CRM for Small Firms.

Understanding Financial Advisor CRM: Beyond Generic Contact Management

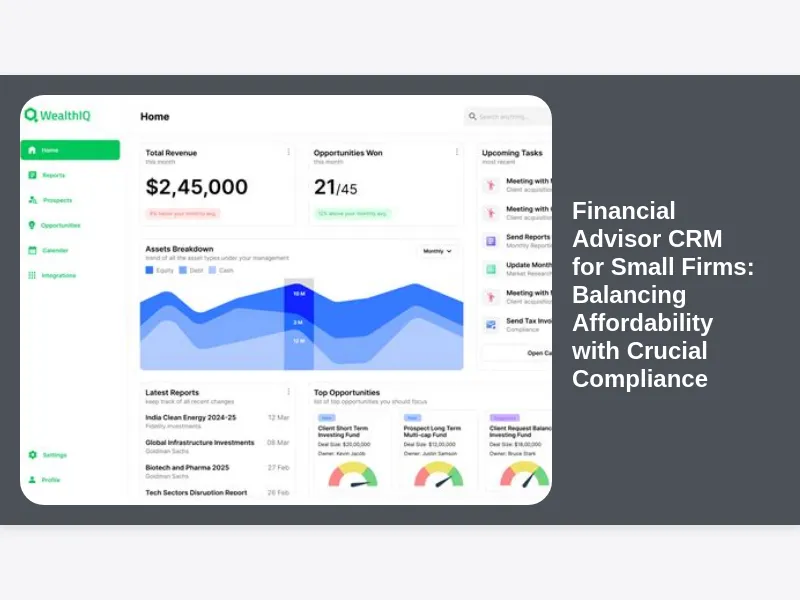

A Financial Advisor CRM is far more than a simple database for client contacts; it’s an integrated system designed to manage every facet of a financial advisor’s relationship with their clients, from initial prospecting to long-term wealth management. While generic CRM platforms like Salesforce or HubSpot offer broad functionalities for sales and marketing, they often lack the specialized tools necessary for the highly regulated and detail-oriented financial services industry. A purpose-built financial CRM includes features like robust portfolio tracking, performance reporting, compliance logging, detailed communication histories, and integration with financial planning software.

This specialized nature ensures that advisors can maintain a holistic view of each client’s financial journey, monitor investment portfolios, track goal progression, and record all interactions—emails, calls, meetings—in a centralized, secure location. Furthermore, a proper financial advisor CRM helps automate workflows specific to the industry, such as onboarding new clients, scheduling annual reviews, or generating regulatory reports. It transforms disparate data points into actionable insights, allowing advisors to proactively address client needs, identify cross-selling opportunities, and provide a superior level of service. For small firms, leveraging such a specialized tool means they can compete effectively and efficiently, without the need to piece together multiple generic systems, which often leads to data silos and compliance risks.

The Imperative of Client Relationship Management for Sustainable Growth

In a competitive landscape where client retention is as crucial as acquisition, effective client relationship management is not just a best practice; it’s an imperative for sustainable growth. For small financial advisory firms, where personal relationships are the cornerstone of their business, a robust CRM system acts as the digital backbone supporting these connections. It ensures that no client detail is overlooked, no communication is missed, and every interaction is tailored to individual needs and preferences. This level of personalized engagement fosters trust and loyalty, significantly increasing client lifetime value.

Beyond retention, a well-implemented CRM also fuels growth by streamlining the prospecting and onboarding processes. Advisors can track leads, manage their sales pipeline, and automate initial outreach, converting prospects into clients more efficiently. Once onboarded, the CRM facilitates consistent communication and proactive service, turning satisfied clients into powerful referral sources. Furthermore, by providing a comprehensive view of client portfolios and financial goals, the CRM enables advisors to identify opportunities for additional services, thereby growing their assets under management (AUM). Ultimately, the ability to manage relationships effectively, automate administrative tasks, and gain actionable insights from client data directly translates into enhanced client satisfaction, increased referrals, and a scalable business model, all of which are critical for small firms aiming for long-term prosperity.

Navigating Affordability: Cost-Effective CRM Solutions for Small Firms

The term “affordability” can be subjective, but for small financial advisory firms, it typically translates to solutions that deliver substantial value without straining limited budgets. Cost-effective CRM solutions are not necessarily the cheapest; rather, they offer the optimal balance between features, support, and price. Many CRM vendors understand the budget constraints of small businesses and offer tiered pricing models, often based on the number of users or specific feature sets. Cloud-based, Software-as-a-Service (SaaS) models are particularly appealing as they eliminate the need for significant upfront hardware investments and ongoing maintenance costs. Subscriptions are typically paid monthly or annually, making the expense predictable and scalable.

When evaluating affordability, small firms must look beyond the sticker price. Factors such as implementation costs (which can include data migration and initial setup), training expenses, ongoing support fees, and potential hidden costs for advanced features or integrations should be considered. Some providers offer free trials or freemium versions, allowing firms to test the waters before committing financially. Furthermore, the true affordability of a CRM is measured by its return on investment (ROI): how much time it saves, how many errors it prevents, and how much it contributes to client retention and new business. A seemingly more expensive CRM that significantly boosts productivity and reduces compliance risks might be more “affordable” in the long run than a cheaper alternative that lacks essential features or causes operational headaches. Therefore, a thorough cost-benefit analysis is crucial when selecting a Financial Advisor CRM for Small Firms.

Unpacking Compliance: Regulatory Requirements for Financial Advisor CRMs

Compliance is non-negotiable in the financial services industry, and a Financial Advisor CRM must be a tool that facilitates, rather than complicates, adherence to regulatory mandates. Regulations such as those from the SEC (Securities and Exchange Commission), FINRA (Financial Industry Regulatory Authority), and state securities boards dictate how client data must be collected, stored, and protected, as well as how communications must be recorded and supervised. For firms dealing with international clients, regulations like GDPR (General Data Protection Regulation) in Europe or similar data privacy laws in other jurisdictions add further layers of complexity. The CRM needs to provide an immutable audit trail of all client interactions, decisions, and recommendations, ensuring that firms can demonstrate “suitability” and “best interest” standards.

Key compliance features include robust data encryption, secure data storage with backups, audit logs that track every user action, and comprehensive archiving capabilities for communications (emails, chat, phone call summaries). The system must support WORM (Write Once, Read Many) storage principles where required, preventing alteration or deletion of critical records. Furthermore, access controls must be granular, allowing firms to restrict sensitive data access based on roles and responsibilities. The CRM should also assist in generating regulatory reports, providing the necessary data points for compliance officers to review and submit. Failure to comply can result in severe penalties, including hefty fines, reputational damage, and even loss of licenses. Thus, selecting a CRM with built-in compliance functionalities and a vendor that understands the regulatory landscape is paramount for small financial advisory firms.

Data Security and Privacy: Non-Negotiable Aspects of Financial Advisor CRM

In an era of increasing cyber threats, data security and privacy are paramount, especially when dealing with sensitive client financial information. For small financial advisory firms, the consequences of a data breach can be catastrophic, leading to severe financial penalties, irreparable damage to reputation, and profound loss of client trust. Therefore, a Financial Advisor CRM for Small Firms must offer state-of-the-art security features that safeguard client data at every point. This includes robust encryption protocols for data both in transit (when being sent over networks) and at rest (when stored on servers). Multi-factor authentication (MFA) should be a standard feature, adding an essential layer of security beyond traditional passwords.

Beyond encryption, comprehensive data backup and disaster recovery plans are critical. The CRM vendor should demonstrate clear strategies for data redundancy and rapid restoration in the event of a system failure or cyberattack, minimizing downtime and data loss. Granular access controls, allowing firms to dictate precisely who can view, edit, or delete specific types of client information, are also vital for internal security and privacy compliance. Regular security audits, vulnerability assessments, and penetration testing by the CRM provider further ensure the system’s integrity against evolving threats. Ultimately, small firms must vet their CRM providers thoroughly, inquiring about their security infrastructure, certifications (e.g., ISO 27001, SOC 2 Type II), and incident response protocols. Client data is the lifeblood of an advisory firm, and its protection is a non-negotiable responsibility that a high-quality CRM must uphold.

Key Features Small Firms Need in a Financial Advisor CRM

While affordability and compliance are critical filters, the practical utility of a Financial Advisor CRM for Small Firms hinges on its core feature set. For small operations, simplicity combined with powerful functionalities is key. At the heart of any financial CRM are comprehensive client profiles, offering a 360-degree view of each client. This includes not just contact information but also family details, financial goals, risk tolerance, portfolio holdings, and a complete history of interactions. Detailed portfolio tracking capabilities are essential, allowing advisors to monitor investments, performance, and asset allocation directly within the CRM, often through integrations with custodians.

Efficient task management and workflow automation are also vital for small teams. The CRM should allow advisors to create tasks, set reminders, and automate routine processes like client onboarding, annual reviews, or birthday greetings. Communication logging, including the ability to sync emails, record call notes, and document meeting summaries, ensures a comprehensive and auditable record of client interactions. Reporting capabilities are equally important, providing insights into client segmentation, revenue generation, and compliance adherence. Finally, document management features within the CRM, enabling secure storage and retrieval of financial plans, agreements, and statements, streamline operations and enhance data accessibility. These core features empower small firms to deliver highly personalized service efficiently, maintain regulatory compliance, and drive business growth without overwhelming their limited resources.

Integration Capabilities: Seamless Workflow for Enhanced Productivity

In the modern financial advisory practice, no single software solution operates in a vacuum. The true power of a Financial Advisor CRM for Small Firms is often unlocked through its seamless integration capabilities with other essential tools in an advisor’s tech stack. This interconnectedness is crucial for enhancing productivity, eliminating data silos, and providing a unified client experience. For instance, integration with financial planning software (e.g., Orion, eMoney, MoneyGuidePro) allows advisors to pull client financial data directly into planning models and push planning summaries back into the CRM, ensuring consistency and accuracy across systems.

Similarly, connections with custodial platforms (e.g., Schwab, Fidelity, TD Ameritrade) enable automated portfolio data feeds, performance reporting, and streamlined rebalancing workflows directly from within the CRM. Email and calendar integrations (e.g., Microsoft Outlook, Google Workspace) are foundational, allowing advisors to automatically log communications and schedule meetings without manual data entry. Document management systems (e.g., DocuSign, SharePoint) can also be linked, providing secure storage and access to client-related paperwork. By fostering a truly integrated ecosystem, a CRM can centralize workflows, reduce manual data entry errors, save countless hours of administrative work, and ensure that all client-related information is up-to-date and accessible from a single pane of glass. This holistic approach is invaluable for small firms striving for operational efficiency and a competitive edge.

Scalability: Ensuring Your CRM Grows with Your Advisory Business

For small financial advisory firms with ambitions for growth, the concept of scalability in a CRM is paramount. A solution that meets current needs but cannot adapt to future expansion will quickly become a bottleneck, necessitating a costly and disruptive migration to a new system down the line. When choosing a Financial Advisor CRM for Small Firms, consider whether the platform can gracefully accommodate an increasing number of clients, advisors, and assets under management. This means assessing not just the current pricing tiers but also the vendor’s roadmap for new features and capabilities.

Scalability also extends to the CRM’s ability to handle growing data volumes without performance degradation. As a firm accumulates more client data, documents, and historical interactions, the system must remain fast and responsive. Cloud-based CRMs generally offer superior scalability as the vendor manages the underlying infrastructure, allowing for easy addition of users and storage capacity. Furthermore, a scalable CRM should offer flexibility in terms of customizable workflows and reporting, allowing the firm to adapt the system to evolving business processes and regulatory requirements. Choosing a CRM that can evolve with your firm’s success ensures that your technology investment remains valuable for the long term, preventing the costly headache of outgrowing your core client management system.

Evaluating CRM Vendors: A Due Diligence Checklist for Small Firms

Selecting the right Financial Advisor CRM for Small Firms requires more than just reviewing feature lists; it demands thorough due diligence of potential vendors. Begin by clearly defining your firm’s specific needs, budget constraints, and compliance requirements. Once you have a shortlist of potential CRMs, initiate detailed conversations with sales representatives, but remember to look beyond the sales pitch. Request comprehensive product demonstrations, focusing on scenarios relevant to your daily operations, such as client onboarding, service requests, and compliance reporting.

Crucially, inquire about the vendor’s commitment to security and compliance, asking for details on their data protection protocols, audit trails, and how they stay abreast of evolving financial regulations. Don’t hesitate to request testimonials or case studies from other small financial advisory firms who are using their product, and if possible, speak directly with current users to get candid feedback on usability, support, and overall satisfaction. Understand their pricing structure fully, including any hidden fees for implementation, training, or premium support. A reputable vendor will offer transparent pricing and be willing to discuss all potential costs. Finally, evaluate their customer support channels, training resources, and implementation process. A strong support system is invaluable, especially for smaller firms without dedicated IT staff. This comprehensive evaluation ensures you’re choosing a partner, not just a product, that aligns with your firm’s long-term vision.

The Implementation Journey: Best Practices for Rolling Out a New CRM

Implementing a new Financial Advisor CRM for Small Firms is a significant undertaking that, if executed poorly, can lead to frustration, resistance, and ultimately, a failed investment. A structured implementation journey is key to success. The first step involves thorough planning: clearly defining goals, establishing a realistic timeline, and allocating internal resources. Identify key stakeholders who will champion the CRM within the firm. Data migration is often the most challenging phase, requiring meticulous effort to cleanse existing client data and accurately transfer it into the new system. This is an opportune time to identify and rectify any inconsistencies or outdated information.

Once data is migrated, comprehensive training for all users is paramount. Generic tutorials are rarely sufficient; tailor training sessions to your firm’s specific workflows and demonstrate how the CRM will address daily challenges and improve efficiency. User adoption is heavily influenced by how well employees understand the “why” and “how” of the new system. Post-implementation, continuous monitoring and optimization are essential. Gather feedback from users, address any issues promptly, and provide ongoing support and refresher training. Celebrate early wins to build momentum and demonstrate the tangible benefits of the new CRM. A successful implementation not only streamlines operations but also fosters a culture of efficiency and data-driven decision-making, ensuring that your firm fully leverages its new client management capabilities.

Measuring ROI: The Tangible Benefits of a Well-Chosen Financial Advisor CRM

For any business, especially a small financial advisory firm, justifying an investment in technology like a CRM often comes down to its return on investment (ROI). While some benefits are intangible (like improved client satisfaction), many can be quantified, demonstrating the tangible value of a well-chosen Financial Advisor CRM for Small Firms. One of the most immediate returns comes from increased operational efficiency. By automating routine administrative tasks—such as scheduling appointments, sending reminders, and logging communications—advisors gain back valuable hours that can be reallocated to high-value activities like client interactions, financial planning, or prospecting. This reduction in administrative overhead translates directly into cost savings and increased capacity.

Furthermore, a robust CRM improves client retention and acquisition. By enabling proactive, personalized communication and ensuring no client falls through the cracks, it fosters deeper relationships, leading to higher client loyalty and increased referrals. Quantifying this can involve tracking client churn rates pre and post-CRM implementation, as well as the average value of new client acquisitions. Reduced compliance risk is another significant ROI factor; by providing a comprehensive audit trail and ensuring data security, the CRM minimizes the likelihood of costly regulatory fines and reputational damage. While harder to assign a direct monetary value, avoiding such penalties is a substantial benefit. Ultimately, the ROI of a financial advisor CRM extends beyond simple cost savings, encompassing enhanced client relationships, improved decision-making through better data, and a more scalable, resilient business model.

Overcoming Common Challenges: Pitfalls to Avoid in CRM Adoption

While the benefits of a Financial Advisor CRM for Small Firms are clear, the adoption process is not without its hurdles. Being aware of common challenges allows firms to proactively mitigate risks and ensure a smoother transition. One of the most frequent pitfalls is resistance to change from staff. Advisors and support teams, accustomed to existing (even if inefficient) workflows, may be reluctant to learn a new system. This can be countered by involving them in the selection process, clearly communicating the benefits, and providing thorough, hands-on training tailored to their roles. Highlighting how the CRM will simplify their daily tasks and free up time is crucial for gaining buy-in.

Another significant challenge is poor data quality or incomplete data migration. Importing messy, duplicated, or outdated client information into a new CRM will simply perpetuate existing problems and undermine the system’s utility. A dedicated data cleansing phase before migration is essential, though often underestimated. Lack of consistent usage post-implementation can also diminish the CRM’s value. If advisors don’t consistently log interactions or update client profiles, the system becomes a ‘dumping ground’ rather than a single source of truth. Establishing clear protocols for data entry and ongoing usage, coupled with regular audits and refresher training, can help enforce best practices. Finally, selecting an overly complex or feature-rich CRM that overwhelms small teams can lead to underutilization. Opting for a solution that is intuitive, scalable, and offers features genuinely needed by a small firm can prevent this pitfall, ensuring the CRM becomes a valuable asset rather than a burdensome obligation.

The Future of Financial Advisor CRM: AI, Automation, and Personalization

The landscape of Financial Advisor CRM for Small Firms is continuously evolving, driven by advancements in technology and changing client expectations. The future promises even greater integration of artificial intelligence (AI) and advanced automation, which will further revolutionize how financial advisors manage client relationships and streamline operations. AI-powered analytics could offer predictive insights, helping advisors identify clients at risk of attrition, pinpoint new cross-selling opportunities, or anticipate client needs based on their financial lifecycle and market events. This proactive intelligence will enable a higher degree of personalized service, freeing up advisors to focus on strategic advice rather than data analysis.

Automation is also set to become more sophisticated, moving beyond simple task management to intelligent workflow orchestration. Imagine a CRM that automatically triggers relevant compliance checks based on a client’s transaction, or one that drafts personalized communication templates based on recent market shifts, requiring only a final review from the advisor. Voice assistants and natural language processing (NLP) could make data entry and information retrieval even more seamless. Furthermore, the emphasis on hyper-personalization will continue to grow, with CRMs offering tools that allow advisors to tailor every touchpoint, from investment recommendations to educational content, to each client’s unique preferences and communication style. For small firms, embracing these future trends will be key to maintaining a competitive edge, delivering exceptional client experiences, and scaling their businesses efficiently in an increasingly digital world.

Strategic Partnerships and Support: What to Expect from Your CRM Provider

When a small financial advisory firm invests in a Financial Advisor CRM for Small Firms, they are not just purchasing software; they are entering into a strategic partnership with the CRM provider. The quality of this partnership, particularly in terms of support, can significantly impact the success and long-term utility of the CRM. A reliable vendor should offer multiple channels for customer support, including phone, email, and live chat, with responsive and knowledgeable staff who understand the nuances of the financial advisory industry. Timely resolution of technical issues and thoughtful answers to operational questions are crucial, especially for firms without dedicated in-house IT support.

Beyond reactive support, proactive resources are equally important. Look for providers who offer comprehensive knowledge bases, detailed user guides, video tutorials, and webinars to help your team maximize their use of the CRM. Regular updates and feature enhancements are also a sign of a committed partner, indicating that the vendor is continually investing in their product to meet evolving industry needs and regulatory changes. Some providers may even offer dedicated account managers or community forums where users can share best practices and troubleshoot issues collectively. A strong support ecosystem ensures that your firm can overcome challenges, leverage new functionalities, and continually optimize its use of the CRM, making the technology a true enabler of your business growth.

Before You Buy: Preparing Your Firm for a Financial Advisor CRM Solution

Before diving into product demonstrations and vendor comparisons for a Financial Advisor CRM for Small Firms, it’s crucial for your firm to undergo a period of internal preparation. This preliminary work will clarify your needs, streamline the selection process, and lay the groundwork for a successful implementation. Start by conducting a thorough internal assessment of your current client management processes. What are the pain points? Where are the inefficiencies? Are you struggling with fragmented data, inconsistent communication, or manual compliance checks? Identifying these specific challenges will help you articulate the “why” behind needing a CRM and define clear objectives for what the new system must achieve.

Next, involve your team. Gather input from advisors, support staff, and compliance officers on their daily workflows and what features would genuinely enhance their productivity. This collaborative approach fosters buy-in and ensures that the chosen CRM will meet the practical needs of those who will use it daily. Document your firm’s current technology stack and identify any existing systems that the new CRM must integrate with, such as financial planning software, custodians, or document management solutions. Finally, establish a realistic budget, not just for the software subscription but also for potential implementation costs, training, and ongoing support. By meticulously preparing your firm, you’ll approach the CRM selection process with clarity and confidence, significantly increasing the likelihood of choosing a solution that truly aligns with your strategic goals.

Beyond the Initial Purchase: Continuous Optimization of Your CRM

The acquisition and initial implementation of a Financial Advisor CRM for Small Firms are merely the first steps in a continuous journey. To truly maximize the return on your investment, firms must commit to ongoing optimization and adaptation of their CRM system. The financial advisory landscape is dynamic, with evolving client needs, new regulations, and technological advancements. Your CRM should be a living system that adapts to these changes, not a static tool. Regularly review how your team is using the CRM, identifying any underutilized features or areas where workflows could be further streamlined. Encourage feedback from users; they are on the front lines and can provide invaluable insights into practical improvements.

Periodically, revisit your firm’s strategic goals and assess whether the CRM is still effectively supporting them. Are there new features from the vendor that could be leveraged? Are there opportunities to automate additional tasks? Consider holding regular training refreshers or “power user” sessions to ensure that all staff are up-to-date on the CRM’s capabilities and best practices. As your firm grows and its needs evolve, you may find that existing workflows need to be adjusted within the CRM, or new integrations become necessary. Embracing this mindset of continuous improvement ensures that your Financial Advisor CRM for Small Firms remains a highly effective, compliant, and indispensable asset, consistently contributing to your firm’s efficiency, client satisfaction, and long-term success.

Conclusion: Striking the Balance for Enduring Success

For small financial advisory firms, the decision to invest in a client relationship management system is a strategic one that profoundly impacts their operational efficiency, client satisfaction, and regulatory standing. The core challenge lies in striking the delicate yet crucial balance between affordability and compliance when selecting a Financial Advisor CRM for Small Firms. It’s not about finding the cheapest option, nor is it about overspending on features that won’t be utilized. Instead, it’s about identifying a solution that offers robust, industry-specific functionalities while fitting within budget constraints and, most importantly, ensuring unwavering adherence to the complex web of financial regulations.

A well-chosen CRM empowers small firms to deliver highly personalized service at scale, automate tedious administrative tasks, and maintain an immutable audit trail of all client interactions. It transforms disparate data into actionable insights, fosters deeper client relationships, and significantly mitigates compliance risks. By conducting thorough due diligence, prioritizing seamless integrations, and committing to continuous optimization, small advisory firms can leverage their CRM as a foundational pillar for sustainable growth. In a competitive and highly regulated environment, a compliant and affordable financial advisor CRM is not just a tool; it’s a strategic imperative for enduring success and client trust.