Navigating the complex world of manufacturing finance can feel like an intricate dance, especially for small businesses. You’re juggling raw material costs, production schedules, labor expenses, and fluctuating market demands, all while trying to maintain healthy cash flow and profitability. In this challenging environment, traditional financial management methods often fall short, leaving many small manufacturers struggling with limited visibility, delayed insights, and reactive decision-making. But what if there was a way to not just manage, but truly master your financial operations, transforming them from a source of stress into a strategic advantage?

The answer lies in the powerful synergy of Cloud ERP for Small Manufacturing Finance. This isn’t just another software solution; it’s a comprehensive ecosystem designed to integrate, automate, and optimize every facet of your financial and operational processes. Imagine having real-time data at your fingertips, understanding the true cost of every product, and forecasting cash flow with unprecedented accuracy. This article will delve deep into how embracing Cloud ERP can revolutionize your small manufacturing business, providing the tools and insights needed to thrive in today’s competitive landscape and achieve true mastery of your financial management.

The Unique Financial Landscape of Small Manufacturing Businesses

Small manufacturing businesses operate within a distinctive financial environment, characterized by a set of challenges that differ significantly from service-oriented companies or large corporations. The very nature of converting raw materials into finished goods introduces layers of complexity that demand robust and precise financial oversight. For many, simply keeping the lights on and managing day-to-day transactions consumes an inordinate amount of time and resources, often leaving little room for strategic financial planning.

A core aspect of this unique landscape is the intricate dance of inventory management, which directly impacts working capital and profitability. Manufacturers must procure raw materials, track work-in-progress, and manage finished goods inventory, each stage tying up capital. Fluctuations in material costs, supplier lead times, and customer demand can quickly throw financial projections off course, making accurate cost accounting and forecasting absolutely critical. Without a clear, integrated view, small manufacturers often find themselves making decisions based on incomplete or outdated information, which can lead to costly errors and missed opportunities for growth.

Why Traditional Financial Management Falls Short for Manufacturers

For years, many small manufacturing companies have relied on a patchwork of traditional financial management tools. This often includes standalone accounting software, a myriad of spreadsheets for inventory and production tracking, and manual processes for everything from invoicing to payroll. While these tools might offer basic functionality, their inherent limitations create significant bottlenecks and vulnerabilities that hinder true financial mastery, especially in a dynamic manufacturing environment.

The fundamental problem with these traditional approaches is their lack of integration. Data resides in silos, meaning information entered into one system isn’t automatically updated in another. This leads to tedious manual data entry, which is not only time-consuming but also highly prone to human error. Imagine the disconnect when your production team updates inventory in one system, but your finance team isn’t immediately aware, leading to discrepancies in cost of goods sold or inaccurate financial statements. This fragmented approach prevents a holistic view of the business, making it nearly impossible to gain real-time insights into profitability, cash flow, or the true cost of production. Without a unified system, small manufacturers are often reacting to problems rather than proactively managing their finances.

Understanding Cloud ERP and Its Core Advantages for Manufacturing

At its heart, Cloud ERP, or Enterprise Resource Planning, is a comprehensive suite of integrated business management applications delivered over the internet, typically on a subscription basis (SaaS – Software as a Service). Instead of installing and maintaining software on local servers, manufacturers access the system via a web browser, leveraging the vendor’s secure data centers. This fundamental shift in delivery model brings a host of advantages that are particularly transformative for small manufacturing finance teams, moving them away from the limitations of legacy systems and into an era of digital efficiency.

One of the most compelling advantages for small manufacturers is the significantly lower upfront investment compared to traditional on-premise ERP systems. There’s no need to purchase expensive servers, databases, or hire dedicated IT staff to manage the infrastructure. Instead, businesses pay a predictable monthly or annual subscription fee, making advanced financial management capabilities accessible even for companies with tighter budgets. Furthermore, cloud ERP solutions offer unparalleled accessibility, allowing authorized users to access critical financial and operational data from anywhere, at any time, on any device with an internet connection. This flexibility is invaluable in today’s remote and hybrid work environments, fostering collaboration and ensuring continuity of operations, all while the cloud provider handles maintenance, security updates, and disaster recovery, freeing your team to focus on manufacturing, not IT.

Real-time Financial Visibility: A Cornerstone of Effective Financial Management

In the fast-paced world of small manufacturing, having accurate, up-to-the-minute financial data isn’t just a luxury; it’s an absolute necessity for survival and growth. Traditional methods, with their reliance on manual data entry and batch processing, often provide financial insights days or even weeks after the events have occurred. This delay means that by the time you see a financial report, the underlying conditions may have already changed, rendering the information less effective for critical decision-making.

Cloud ERP, by contrast, fundamentally changes this paradigm by offering real-time financial visibility. Because all operational data—from sales orders and material purchases to production costs and shipping —is captured and processed within a single, integrated system, financial records are updated instantaneously. This means that as soon as a raw material order is placed, or a product moves from work-in-progress to finished goods, the financial impact is immediately reflected in the general ledger, inventory valuations, and profitability reports. For small manufacturing operations, this immediate insight is a game-changer. It empowers owners and finance managers to identify trends, spot potential issues like cost overruns or cash flow bottlenecks early, and make proactive, data-driven decisions that can significantly impact the bottom line, moving from reactive problem-solving to strategic financial leadership.

Streamlining Inventory Management with Cloud ERP for Manufacturers

For any manufacturing business, inventory is a double-edged sword: essential for production, yet a significant drain on working capital if not managed precisely. Small manufacturers often struggle with inventory management, leading to issues such as excess stock tying up valuable cash, stockouts that halt production and disappoint customers, or inaccurate valuations skewing financial reports. The link between inventory and financial health is undeniable, and it’s a critical area where Cloud ERP for Small Manufacturing Finance excels.

A robust Cloud ERP system seamlessly integrates inventory management with the general ledger, accounts payable, and accounts receivable, providing a unified view of your stock’s financial impact. It tracks every item from raw material receipt through work-in-progress to finished goods, automatically updating inventory valuations and cost of goods sold as transactions occur. This integration allows manufacturers to implement sophisticated inventory strategies like just-in-time (JIT) manufacturing, optimize reorder points, and reduce carrying costs. Furthermore, accurate inventory data ensures that balance sheets reflect true asset values, and profitability calculations are based on actual material costs, rather than estimates. By providing granular control and real-time insights into stock levels and movement, Cloud ERP helps small manufacturers turn their inventory from a potential liability into a finely tuned asset, directly improving cash flow and overall financial performance.

Precision in Production Cost Tracking and Analysis

One of the most elusive yet crucial aspects of financial management in small manufacturing is accurately tracking and analyzing production costs. Without a clear understanding of what it truly costs to produce each item, it’s virtually impossible to set competitive prices, identify profitable product lines, or make informed decisions about process improvements. Many small manufacturers rely on broad averages or outdated cost calculations, which can lead to underpricing, lost profits, or even taking on unprofitable orders without realizing it.

Cloud ERP systems are designed to bring unparalleled precision to production cost tracking. They integrate data from various operational modules—including purchasing for raw material costs, labor tracking for direct labor expenses, and machine usage for overhead allocation—to provide a comprehensive, real-time picture of your manufacturing costs. This means you can accurately assign costs to specific work orders, batches, or individual products, differentiating between direct materials, direct labor, and manufacturing overhead. With this granular data, small manufacturing finance teams can perform detailed variance analysis, comparing actual costs against budgeted costs, and quickly pinpointing areas of inefficiency or unexpected expenses. This level of precision empowers businesses to optimize their production processes, renegotiate supplier contracts, and make strategic pricing adjustments, ultimately leading to improved profitability and a deeper understanding of their true financial standing.

Optimizing Cash Flow and Working Capital in Small Manufacturing Finance

Cash flow is the lifeblood of any business, but for small manufacturers, managing it effectively can be particularly challenging due to long production cycles, fluctuating material costs, and extended payment terms with both suppliers and customers. Without consistent and predictable cash flow, even profitable manufacturing businesses can face liquidity crises, making the optimization of working capital a critical financial priority. Traditional accounting methods often fail to provide the dynamic insights needed to proactively manage cash, leaving businesses vulnerable to unexpected shortages.

Cloud ERP for Small Manufacturing Finance offers powerful tools to optimize both cash flow and working capital. By integrating accounts receivable (AR), accounts payable (AP), and general ledger functions with sales, purchasing, and production, the system provides a holistic view of all financial obligations and incoming funds. This integration allows for automated invoicing, streamlining the collections process and reducing days sales outstanding (DSO). On the accounts payable side, it facilitates better management of supplier payments, potentially leveraging early payment discounts or optimizing payment terms. Crucially, Cloud ERP enables robust cash flow forecasting, allowing small manufacturers to predict future cash positions based on sales forecasts, production schedules, and known expenditures. This proactive approach empowers finance teams to make informed decisions about inventory levels, production scaling, and capital expenditures, ensuring the business maintains healthy liquidity and maximizes its working capital efficiency.

Enhanced Reporting and Compliance for Manufacturing Businesses

Navigating the complex landscape of financial reporting and regulatory compliance can be a significant burden for small manufacturing businesses. From internal management reports that drive strategic decisions to external reports for tax authorities, investors, or industry bodies, the demand for accurate, timely, and compliant financial statements is relentless. Manual compilation of these reports is not only time-consuming but also increases the risk of errors, potentially leading to fines, audits, or a loss of trust from stakeholders.

Cloud ERP for Small Manufacturing Finance dramatically simplifies and enhances the reporting and compliance process. With all financial and operational data residing in a single, integrated system, generating comprehensive reports becomes an automated task rather than a manual ordeal. The system can instantly produce standard financial statements like income statements, balance sheets, and cash flow statements, tailored to specific accounting standards such as GAAP or IFRS. Beyond standard financial reports, Cloud ERP can generate industry-specific reports vital for manufacturing, such as production cost analyses, inventory valuation reports, and detailed sales by product line. Furthermore, the robust audit trails and data integrity features inherent in Cloud ERP systems ensure that businesses can easily demonstrate compliance with tax regulations, environmental standards, or specific manufacturing certifications. This enhanced reporting capability not only saves countless hours but also provides small manufacturers with the credible, accurate information they need to satisfy regulatory requirements and make informed strategic decisions.

The Power of Integration: Connecting Finance with Operations

One of the most profound benefits of adopting Cloud ERP for Small Manufacturing Finance is the unparalleled level of integration it brings to an organization. In many small manufacturing setups, finance often operates in a silo, receiving data from various operational departments through manual transfers or periodic summaries. This disconnected approach leads to delays, inconsistencies, and a fundamental lack of understanding between the financial realities and the day-to-day operations on the factory floor.

Cloud ERP shatters these silos by creating a seamless, interconnected data flow across the entire enterprise. Imagine a sales order being placed: this instantly triggers updates in inventory (checking availability), production (scheduling new work orders if needed), and finance (generating a provisional revenue entry and customer invoice details). Similarly, when raw materials are purchased, the system updates inventory, accounts payable, and production schedules, all in real-time. This level of integration ensures that the finance department isn’t just a recipient of information but an active participant in the operational flow, with immediate insight into the financial impact of every business activity. For small manufacturing businesses, this means better resource allocation, more accurate cost accounting, and the ability to make strategic decisions based on a complete, unified picture of the entire operation, moving beyond fragmented data to truly connected insights.

Scalability and Future-Proofing Your Small Manufacturing Finance Operations

For small manufacturers with ambitions of growth, the ability of their financial management system to scale alongside their evolving needs is paramount. Traditional software solutions often present a dilemma: either they are quickly outgrown as the business expands, necessitating costly and disruptive migrations, or they are over-engineered for current needs, leading to unnecessary complexity and expense. This lack of inherent scalability can stifle growth, making businesses hesitant to seize new opportunities for fear of overwhelming their existing systems.

Cloud ERP, by its very nature, is designed with scalability in mind, making it an ideal future-proofing solution for small manufacturing finance operations. Cloud providers offer flexible subscription models that allow businesses to easily add users, modules, or increase data storage as their operations expand. Whether you’re adding new product lines, opening another facility, or entering new markets, the Cloud ERP infrastructure can effortlessly accommodate these changes without requiring significant capital expenditure on new hardware or complex software upgrades. This agility means small manufacturers can respond quickly to market demands and business growth without being constrained by their technology. The continuous updates and innovations provided by Cloud ERP vendors also ensure that your financial management system remains cutting-edge, incorporating new features, security enhancements, and compliance updates automatically. This ensures that your business is always equipped with the most advanced tools, allowing you to focus on manufacturing and growth, rather than worrying about the limitations of your financial software.

Boosting Efficiency Through Automation of Financial Processes

In many small manufacturing businesses, finance teams spend an inordinate amount of time on repetitive, manual tasks. From entering invoices and reconciling bank statements to generating standard reports, these operational chores consume valuable hours that could otherwise be dedicated to more strategic activities. This not only creates bottlenecks and potential for error but also prevents finance professionals from contributing to the business’s growth in a meaningful way. The sheer volume of transactions in manufacturing—procurement, production, sales—can quickly overwhelm a manual system.

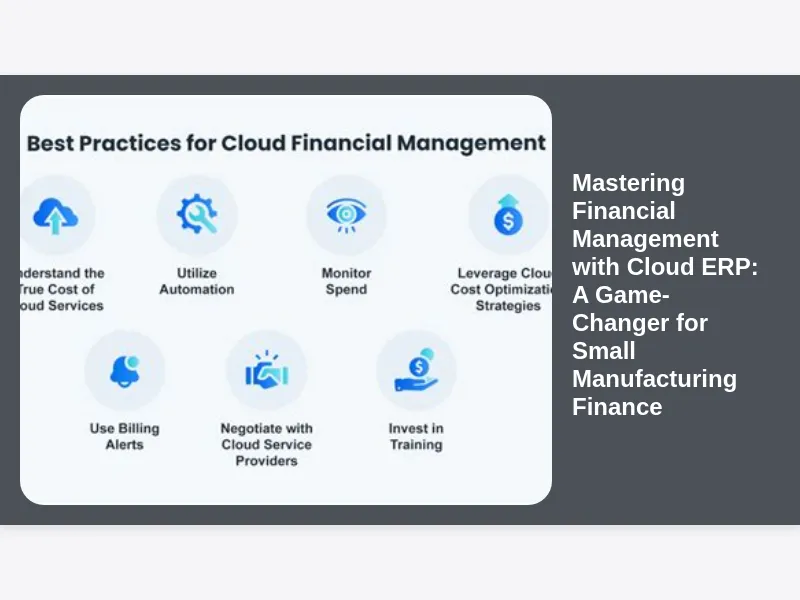

Cloud ERP for Small Manufacturing Finance transforms this landscape by injecting powerful automation capabilities into financial processes. Imagine a purchase order automatically generating an accounts payable entry when goods are received, or a completed sales order automatically creating an invoice and updating revenue accounts. The system can automate bank reconciliations, process recurring journal entries, and even generate complex financial reports with a few clicks. This level of automation significantly reduces manual data entry, virtually eliminates human error, and frees up finance staff from tedious, low-value tasks. By automating routine financial operations, small manufacturers can reallocate their skilled finance personnel to higher-value activities such as cost analysis, strategic planning, cash flow forecasting, and identifying opportunities for profit improvement. This shift from transactional processing to strategic financial management is a key differentiator that Cloud ERP brings, significantly boosting overall operational efficiency.

Data Security and Reliability in Cloud ERP Environments

One of the initial concerns many small manufacturing businesses have when considering a move to Cloud ERP is data security and reliability. The idea of entrusting sensitive financial and operational data to a third-party provider can feel daunting, especially given the increasing threats of cyberattacks and data breaches. It’s a valid concern that deserves thorough consideration, and it’s essential for manufacturers to understand how leading Cloud ERP providers address these critical issues.

Reputable Cloud ERP vendors invest heavily in state-of-the-art security infrastructure, often far exceeding what a small manufacturing business could afford or manage internally. This includes robust physical security for data centers, advanced encryption for data both in transit and at rest, multi-factor authentication, and sophisticated intrusion detection systems. Furthermore, cloud providers typically have comprehensive disaster recovery plans in place, with redundant servers and regular backups, ensuring business continuity even in the face of unexpected outages. Unlike on-premise systems where data loss due to hardware failure or local disasters can be catastrophic, Cloud ERP offers peace of mind with built-in resilience. For small manufacturing finance teams, this means their critical financial data is not only protected by expert security teams working around the clock but is also highly available and reliable, ensuring operations can continue smoothly without interruption, a level of security and reliability that is difficult to achieve with self-managed systems.

Navigating the Implementation of Cloud ERP for Small Manufacturers

Embarking on a Cloud ERP implementation can seem like a monumental undertaking for a small manufacturing business, especially for those accustomed to simpler, siloed systems. The transition involves more than just installing new software; it’s a strategic shift that impacts processes, people, and technology. A well-planned and executed implementation is crucial for realizing the full benefits of Cloud ERP for Small Manufacturing Finance, while a poorly managed one can lead to frustration, delays, and a failure to achieve desired outcomes.

Key to a successful rollout is a clear understanding of your business’s specific needs and a strong partnership with your chosen ERP vendor or implementation partner. This involves thoroughly defining your financial and operational requirements, mapping current processes, and identifying areas for improvement. Data migration, the process of transferring historical financial and operational data from old systems to the new ERP, is a critical step that requires meticulous planning and execution to ensure accuracy and completeness. Equally important is change management and user training. Employees, particularly those in finance and production, need to understand how the new system will work, how their roles might evolve, and how to effectively utilize its features. Investing in comprehensive training and providing ongoing support can significantly reduce resistance to change and accelerate user adoption, ensuring that your small manufacturing finance team can hit the ground running and quickly leverage the powerful capabilities of your new Cloud ERP system.

Measuring the Return on Investment (ROI) of Cloud ERP Adoption

For any significant technology investment, especially for a small manufacturing business, demonstrating a clear return on investment (ROI) is essential. While the benefits of Cloud ERP for Small Manufacturing Finance are numerous, it’s important to quantify these advantages to justify the expenditure and ensure the project aligns with strategic business goals. The ROI isn’t always immediately obvious in direct cost savings alone; it often encompasses a blend of tangible and intangible benefits that collectively drive significant value.

Tangible benefits typically include reductions in operational costs through automation, such as fewer hours spent on manual data entry or reconciliation, leading to lower labor costs. Improved inventory management can drastically reduce carrying costs and obsolescence, freeing up working capital. Enhanced cash flow forecasting helps avoid late payment penalties and optimize investment of surplus funds. Indirect, yet equally powerful, benefits contribute significantly to the ROI. These include improved decision-making due to real-time data, leading to better pricing strategies and more profitable production runs. Increased efficiency and reduced errors translate into better customer satisfaction and a stronger reputation. The scalability of cloud solutions also means avoiding future large capital outlays for IT infrastructure, further contributing to long-term savings. By carefully tracking key performance indicators (KPIs) before and after implementation, small manufacturers can clearly demonstrate how Cloud ERP drives not only cost savings but also significant gains in productivity, agility, and overall business performance, cementing its value as a strategic asset.

Choosing the Right Cloud ERP Solution for Your Manufacturing Needs

The market for Cloud ERP solutions is vast and varied, making the selection process a critical decision for small manufacturing businesses. With numerous vendors offering a range of functionalities, simply picking the most popular or cheapest option can lead to a misalignment with your specific operational and financial requirements. A careful, systematic approach is necessary to ensure the chosen Cloud ERP for Small Manufacturing Finance truly supports your business goals and delivers maximum value.

Start by clearly defining your unique manufacturing processes and identifying the most pressing financial pain points you aim to solve. Do you need robust inventory management for complex bills of material? Is detailed production cost tracking a priority? Are you looking to integrate with specific machinery or CAD software? Look for solutions that offer industry-specific features or modules tailored for discrete, process, or mixed-mode manufacturing. Evaluate vendors based on their reputation, customer support, and track record with small manufacturing businesses. Consider the solution’s flexibility and potential for customization; while cloud solutions offer standardization, some level of configuration to match your unique workflows can be crucial. Don’t forget to assess the user interface and ease of use, as high user adoption is key to success. Request demos, talk to existing customers, and compare pricing models, including implementation and ongoing support costs. By meticulously evaluating these factors, small manufacturers can confidently select a Cloud ERP system that perfectly aligns with their operational realities and financial aspirations, ensuring a powerful foundation for future growth and efficiency.

Overcoming Common Hurdles in Digital Transformation for Small Businesses

Embracing Cloud ERP for Small Manufacturing Finance represents a significant step in digital transformation, a journey that, while immensely beneficial, often comes with its own set of hurdles, particularly for smaller enterprises. These challenges aren’t just technical; they encompass cultural, financial, and organizational aspects that need to be carefully navigated to ensure a smooth and successful transition. Recognizing these obstacles upfront is the first step toward developing effective strategies to overcome them.

One of the most common hurdles is resistance to change from employees accustomed to familiar processes, even if those processes are inefficient. Fear of the unknown, perceived job insecurity, or simply discomfort with new technology can impede adoption. Another significant challenge is budget constraints; while Cloud ERP generally has lower upfront costs, the ongoing subscription fees and potential implementation services still require a financial commitment that small businesses must plan for. Lack of in-house technical expertise to manage the transition or fully leverage the new system can also be a barrier. To mitigate these issues, small manufacturers should prioritize clear communication about the benefits of the ERP, involve employees in the planning process, and provide comprehensive training and ongoing support. Starting with a phased implementation, if possible, can also ease the transition. By addressing these human and financial elements with proactive strategies, small manufacturing businesses can successfully navigate their digital transformation journey, unlocking the full potential of Cloud ERP for their financial management.

The Competitive Edge: How Cloud ERP Elevates Small Manufacturers

In today’s globalized marketplace, small manufacturers often find themselves competing against larger, more resource-rich enterprises. To not only survive but thrive, they need to find ways to gain a distinct competitive edge, differentiating themselves through efficiency, responsiveness, and innovation. Manual processes and fragmented data simply won’t cut it in this demanding environment. This is precisely where Cloud ERP for Small Manufacturing Finance provides a transformative advantage, leveling the playing field and enabling agility previously reserved for much larger players.

By providing real-time financial visibility, precise cost tracking, and automated processes, Cloud ERP allows small manufacturers to operate with greater efficiency and lower operational costs. This efficiency translates into more competitive pricing, better profit margins, and the ability to allocate resources more effectively. Furthermore, the ability to quickly access accurate data empowers faster, more informed decision-making, enabling businesses to respond swiftly to market changes, capitalize on new opportunities, and adapt production schedules to meet customer demands without delay. This newfound agility means small manufacturers can be more responsive to customer needs, deliver higher quality products on time, and build stronger relationships. Ultimately, Cloud ERP moves small manufacturing businesses from merely reacting to market pressures to proactively shaping their future, fostering innovation, and securing a sustainable competitive advantage against any competitor, regardless of size.

Beyond Finance: Holistic Benefits of Cloud ERP Across Your Enterprise

While the focus of this article has been on Mastering Financial Management with Cloud ERP for Small Manufacturing Finance, it’s crucial to understand that the benefits of a robust ERP system extend far beyond the finance department. Cloud ERP is designed as an integrated suite, meaning it connects various functional areas of a business, creating a single source of truth for all operational data. This holistic integration drives improvements across the entire enterprise, making it a powerful tool for overall business transformation.

Beyond optimizing your general ledger, accounts payable, and accounts receivable, Cloud ERP typically includes modules for inventory management, production planning, supply chain management, sales and customer relationship management (CRM), and even human resources. This means that a sales order entered by the sales team instantly impacts inventory levels, production schedules, and financial forecasts. Procurement actions directly affect stock and accounts payable. Production updates flow into inventory and cost accounting. This seamless data exchange eliminates departmental silos, reduces redundant data entry, and improves inter-departmental collaboration. For small manufacturers, this leads to better coordination between sales, production, and finance, improved customer satisfaction through accurate order fulfillment and delivery, and a more streamlined supply chain. Ultimately, Cloud ERP provides a unified, comprehensive view of the entire business, empowering every department to operate more efficiently and contribute to the overall strategic goals, making the business more agile, responsive, and profitable.

The Future of Financial Management: Innovation and Evolution in Cloud ERP

The digital landscape is constantly evolving, and Cloud ERP solutions are at the forefront of this innovation, particularly for small manufacturing finance. What constitutes “mastering financial management” today will likely include even more sophisticated tools and capabilities tomorrow. Cloud ERP providers are continuously investing in research and development, incorporating cutting-edge technologies to offer even greater efficiency, insight, and strategic advantage to their users. This continuous evolution ensures that your investment remains future-proof, adapting to emerging trends and business demands.

One of the most exciting developments is the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities directly into Cloud ERP systems. Imagine AI-powered tools that can automatically identify anomalies in financial transactions, flag potential fraud, or provide highly accurate predictive analytics for cash flow and demand forecasting. Machine learning can refine inventory management by analyzing historical data patterns to optimize reorder points or predict equipment maintenance needs before they become critical, directly impacting production costs. Furthermore, advancements in business intelligence (BI) and advanced reporting tools are making it easier for small manufacturing finance teams to extract deep insights from their data, moving beyond basic reports to interactive dashboards and “what-if” scenario planning. These innovations are transforming financial management from a retrospective record-keeping function into a proactive, strategic intelligence hub, empowering small manufacturers to navigate an increasingly complex world with unparalleled foresight and control.

Conclusion: Embracing the Future of Small Manufacturing Finance

For small manufacturing businesses, the journey to truly mastering financial management can seem daunting. The intricate dance of production costs, inventory, cash flow, and compliance demands a level of precision and real-time insight that traditional tools simply cannot provide. However, as we’ve explored, the advent of Cloud ERP for Small Manufacturing Finance presents a revolutionary solution, offering an integrated, automated, and scalable pathway to financial excellence.

By embracing Cloud ERP, small manufacturers can transition from reactive accounting to proactive financial strategy. They gain unparalleled real-time visibility into every aspect of their operations, from the precise cost of each product to the projected health of their cash flow. They can streamline inventory, automate tedious financial processes, and generate robust reports with ease, ensuring both efficiency and compliance. Beyond the finance department, Cloud ERP fosters enterprise-wide integration, enhancing collaboration and driving holistic business improvement. In a competitive world, the agility, accuracy, and strategic insights offered by Cloud ERP are not just beneficial; they are essential for sustainable growth and long-term success. The future of small manufacturing finance is digital, integrated, and cloud-powered. It’s time to take the leap and transform your financial operations into a true strategic asset.