The world of independent financial planning is dynamic, rewarding, and uniquely challenging. As an independent financial planning firm (IFPF), you juggle client relationships, investment strategies, compliance requirements, and business development—often with a lean team and a watchful eye on the bottom line. In this environment, efficiency isn’t just a buzzword; it’s the bedrock of sustainable growth. This is precisely where cost-effective CRM solutions for independent financial planning firms emerge not just as a luxury, but as an absolute necessity.

The Growing Imperative for Independent Financial Planners to Embrace CRM

In today’s competitive financial landscape, an independent financial planning firm cannot rely solely on its expertise in wealth management. Client expectations have soared, demanding personalized attention, proactive communication, and seamless service delivery. Without a robust system to manage these intricate relationships, even the most skilled advisors risk losing out to larger institutions with seemingly endless resources. This is why CRM, or Customer Relationship Management, has become a cornerstone technology for modern financial practices. It’s more than just a contact list; it’s a strategic asset that centralizes client data, automates routine tasks, and enhances client engagement, ultimately allowing advisors to spend more time advising and less time administrating. For IFPFs, the challenge isn’t just acquiring a CRM but finding one that delivers maximum value without overburdening the budget.

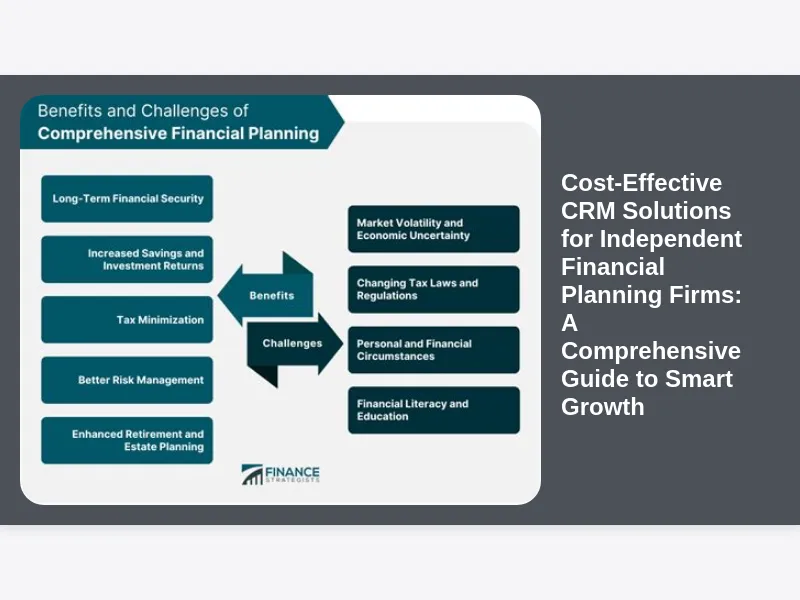

Navigating the Unique Challenges Faced by Independent Financial Planning Firms

Independent financial planning firms operate within a distinct set of constraints and opportunities. Unlike their counterparts in large brokerage houses or banks, IFPFs often have smaller budgets, fewer dedicated IT resources, and a greater need for versatile, all-in-one solutions. They are typically responsible for their own marketing, compliance, and back-office operations, making every dollar spent on technology a critical investment. The overhead of enterprise-level software can be prohibitive, yet the need for sophisticated client management tools remains just as pressing, if not more so. Furthermore, the regulatory landscape is constantly evolving, requiring stringent record-keeping and data security measures, which adds another layer of complexity to their operations. Balancing these demands with the core mission of providing exceptional financial guidance necessitates smart, strategic technology choices, particularly when it comes to client relationship management systems.

Defining “Cost-Effective” in the Context of Financial Advisor CRM

When we talk about “cost-effective CRM solutions for independent financial planning firms,” it’s crucial to understand that we’re not simply referring to the cheapest option on the market. True cost-effectiveness encompasses much more than the initial sticker price or monthly subscription fee. It’s about the total cost of ownership (TCO) over time, including implementation, training, integration with other systems, and ongoing support. More importantly, it’s about the return on investment (ROI) that the CRM delivers. A truly cost-effective solution is one that generates tangible benefits—such as increased client retention, improved operational efficiency, higher client satisfaction, and ultimately, greater profitability—that far outweigh its monetary cost. It should align with your firm’s specific needs, scale with your growth, and provide a measurable uplift in productivity and client engagement, all while fitting comfortably within your budgetary constraints.

Essential Features of a Budget-Friendly CRM for Financial Advisors

For independent financial planning firms, a cost-effective CRM isn’t about compromising on critical functionality; it’s about identifying the core features that deliver the most impact for their specific needs. At its heart, such a system must offer robust contact management, providing a 360-degree view of each client, including their financial history, communication logs, family details, and service preferences. Beyond that, integrated calendar and task management are non-negotiable, ensuring no client follow-up or important deadline is missed. Document management capabilities are also vital for securely storing client agreements, financial plans, and other sensitive paperwork. Crucially, a budget-friendly CRM for financial advisors should also include basic reporting and analytics to track client interactions, measure business performance, and identify areas for improvement. While advanced features found in enterprise-level solutions might be enticing, a truly cost-effective choice focuses on the essential tools that directly support client service and operational efficiency without unnecessary complexity or expense.

Cloud-Based vs. On-Premise: The Clear Winner for Small Financial Firms

When exploring cost-effective CRM solutions for independent financial planning firms, one of the fundamental decisions revolves around deployment: cloud-based (SaaS) or on-premise. For most independent financial planning firms, the cloud-based model emerges as the undisputed champion in terms of cost-effectiveness and operational simplicity. On-premise solutions require significant upfront capital investment in hardware, software licenses, and ongoing maintenance from dedicated IT staff—a luxury most small financial firms simply cannot afford. Cloud-based CRMs, on the other hand, operate on a subscription model, eliminating large capital outlays and converting IT expenses into predictable operational costs. Furthermore, the vendor handles all updates, security patches, and infrastructure management, freeing up valuable time and resources for the financial firm. This not only lowers the total cost of ownership but also ensures greater accessibility, scalability, and security, making cloud solutions an ideal match for the agility and budget constraints of independent advisors.

Upholding Data Security and Regulatory Compliance with Your CRM

For any financial institution, and particularly for independent financial planning firms, data security and regulatory compliance are not optional—they are absolutely paramount. The very nature of the business involves handling highly sensitive personal and financial information, making IFPFs prime targets for cyber threats. A truly cost-effective CRM solution for independent financial planning firms must therefore embed robust security features and facilitate adherence to industry regulations like FINRA, SEC, and privacy laws such as GDPR or CCPA. This includes features like multi-factor authentication, data encryption both in transit and at rest, regular security audits, and detailed audit trails to track all user activity. Beyond technical security, the CRM should also aid in compliance by providing structured ways to document client communications, track disclosure requirements, and manage sensitive client data according to regulatory mandates. Investing in a CRM that prioritizes these aspects is not just about avoiding penalties; it’s about protecting client trust and the firm’s reputation, making it an indispensable part of its overall value proposition.

Automating Workflows: A Key to Cost Savings and Efficiency Gains

One of the most significant ways a CRM delivers on its promise of cost-effectiveness for independent financial planning firms is through workflow automation. Manual, repetitive tasks consume valuable time that could otherwise be spent on client-facing activities or strategic planning. A well-implemented CRM can automate a myriad of these processes, from client onboarding and scheduling follow-up meetings to generating routine reports and sending personalized communications. Imagine a new client joining your firm: instead of manually creating multiple tasks, sending separate welcome emails, and setting reminders, the CRM can trigger a pre-defined workflow that handles all these steps automatically, notifying the advisor only when specific actions are required. This not only dramatically reduces administrative overhead and minimizes the risk of human error but also ensures consistency in service delivery. By freeing up advisors and support staff from tedious chores, automation allows them to focus on high-value activities, directly contributing to increased productivity and profitability without the need to hire additional personnel, thus making it a truly cost-effective CRM solution for independent financial planning firms.

Cultivating Stronger Client Relationships Through Personalized Engagement

At the heart of independent financial planning lies the strength of client relationships. Clients choose independent advisors for their personalized touch and trusted guidance. A powerful CRM system, even one that is highly cost-effective, significantly enhances an firm’s ability to deliver this bespoke experience at scale. By centralizing all client interactions, preferences, life events, and financial goals, the CRM empowers advisors with a 360-degree view of each client. This rich data allows for highly personalized communication, whether it’s remembering a client’s child’s college plans or acknowledging a significant life event. Advisors can segment clients based on various criteria, enabling targeted marketing campaigns, relevant service offerings, and proactive outreach. When clients feel truly understood and valued, their loyalty deepens, leading to higher retention rates and valuable referrals. This ability to nurture deep, long-lasting client relationships is a profound, albeit often indirect, measure of a CRM’s cost-effectiveness, as it directly translates into sustainable business growth for independent financial planning firms.

Seamless Integration with Existing Financial Planning Tools

Independent financial planning firms often utilize a suite of specialized tools for various aspects of their operations, including portfolio management software, financial planning platforms, risk assessment tools, and accounting solutions. For a CRM to be truly cost-effective for independent financial planning firms, it must not operate in a silo. The ability to seamlessly integrate with these existing platforms is critical. Such integrations eliminate the need for manual data entry across multiple systems, reducing errors, saving considerable time, and ensuring data consistency. Imagine an advisor updating a client’s financial plan in their planning software, and that information automatically populating relevant fields in the CRM, or client contact details from the CRM flowing directly into the billing system. This interoperability creates a unified technological ecosystem, streamlining workflows and providing a holistic view of the client’s financial journey without the friction of switching between disparate applications. Prioritizing CRMs with robust integration capabilities enhances efficiency and maximizes the value of all your technological investments.

Scalability: Ensuring Your CRM Grows with Your Financial Firm

One of the most important considerations for independent financial planning firms investing in technology is scalability. A CRM solution that might be perfectly adequate for a solo advisor today could quickly become a bottleneck as the firm expands, adds new advisors, or grows its client base. A truly cost-effective CRM solution for independent financial planning firms is one that can effortlessly scale up or down to meet evolving business needs without requiring a complete system overhaul or exorbitant upgrade costs. This means looking for flexible licensing models that allow you to add or remove users easily, storage capacities that can be expanded as your data grows, and the ability to add more advanced features or integrations as your firm’s requirements become more sophisticated. Choosing a scalable CRM from the outset protects your initial investment, ensures long-term utility, and prevents future disruptions, allowing your firm to adapt and thrive without technological limitations hindering its growth trajectory.

Understanding Pricing Models: Navigating the Options for Budget-Conscious Firms

When evaluating cost-effective CRM solutions for independent financial planning firms, understanding the various pricing models is crucial. Most cloud-based CRMs typically offer subscription-based pricing, commonly structured as per-user, per-month, or per-year. Some providers may offer tiered pricing, where different levels (e.g., “Basic,” “Professional,” “Enterprise”) come with varying feature sets and corresponding costs. For smaller firms, a per-user model can be highly advantageous, as you only pay for the licenses you need. It’s important to scrutinize what each tier includes: are essential features like robust reporting or specific integrations locked behind higher-priced plans? Beyond the core subscription, look out for potential hidden costs such as setup fees, data migration charges, premium support costs, or fees for add-on modules. Carefully comparing these structures and mapping them against your firm’s specific needs and budget will help you identify a solution that is transparently priced and genuinely cost-effective, ensuring no unpleasant surprises down the line.

Exploring Open-Source CRM Solutions: A Deeper Dive into Affordability

For independent financial planning firms on a particularly tight budget, open-source CRM solutions present an intriguing and potentially highly cost-effective alternative. Unlike proprietary software, open-source CRMs like SuiteCRM or SugarCRM Community Edition offer their core software free of charge, eliminating initial licensing fees. This can significantly reduce the upfront investment. However, “free” often comes with its own set of considerations. While the software itself is free, implementing, customizing, and maintaining an open-source CRM typically requires a greater degree of technical expertise. You might need to hire developers or invest in professional support services, which then adds to the total cost of ownership. The community support is often robust, but dedicated, guaranteed support is usually a paid service. For firms with in-house technical capabilities or a willingness to learn, open-source can offer unparalleled flexibility and customization. Yet, for many independent financial advisors who prefer a ready-to-use, fully supported solution, the perceived initial cost savings might be offset by the demands of managing and troubleshooting the system independently.

Industry-Specific vs. General CRMs: Tailoring the Fit for Financial Planning

When choosing a cost-effective CRM solution for independent financial planning firms, a key decision is whether to opt for a general-purpose CRM (like Salesforce, Zoho CRM, or Microsoft Dynamics) or an industry-specific CRM designed specifically for financial services (like Redtail, Wealthbox, or Tamarac). General CRMs are often highly customizable and can be configured to meet many of the needs of financial advisors. They may also benefit from a larger ecosystem of integrations and a broader user base, potentially making them more cost-effective if your needs are relatively standard. However, they typically require more setup and customization to align with financial industry workflows and compliance requirements. On the other hand, industry-specific CRMs come pre-built with features tailored to financial planning, such as robust compliance logging, integration with financial data feeds, and specialized reporting for advisors. While sometimes appearing more expensive on a per-user basis, their out-of-the-box functionality can lead to quicker implementation and less ongoing customization, making them highly cost-effective in terms of time saved and immediate relevance to your practice. The choice often boils down to the firm’s specific niche, the complexity of its needs, and its willingness to invest in customization versus specialized out-of-the-box functionality.

The CRM Implementation Process: Ensuring a Smooth and Cost-Efficient Transition

The success and true cost-effectiveness of any CRM solution for independent financial planning firms heavily depend on a well-executed implementation process. Rushing into deployment without proper planning can lead to frustration, user resistance, and ultimately, a system that doesn’t deliver its promised value—rendering it anything but cost-effective. The implementation journey should begin with a clear definition of your firm’s needs and goals, identifying which workflows will be streamlined and what data needs to be migrated. Data migration is a critical step; dirty or incomplete data will cripple even the best CRM. Therefore, investing time in cleaning and organizing your existing client information before the migration is paramount. Furthermore, comprehensive user training is non-negotiable. Advisors and support staff must understand how to effectively use the new system to fully leverage its capabilities. Phased rollouts, starting with a pilot group, can also help identify and resolve issues before a full firm-wide launch. A methodical, well-planned implementation minimizes disruptions, maximizes user adoption, and ensures your investment truly pays off.

Measuring the Return on Investment (ROI) of Your CRM Investment

For independent financial planning firms, understanding the return on investment (ROI) of a CRM is crucial for justifying the expense and demonstrating its true cost-effectiveness. ROI extends beyond just cost savings; it encompasses the tangible and intangible benefits that directly impact your firm’s bottom line and operational efficiency. Quantifiable metrics might include reduced administrative hours per week, leading to higher billable hours, an increase in client referrals and new client acquisitions, a reduction in client churn rates, or improved compliance audit outcomes. Intangible benefits, though harder to measure directly, are equally vital: enhanced client satisfaction, improved team collaboration, reduced stress for advisors, and a more professional brand image. By tracking key performance indicators (KPIs) before and after CRM implementation, such as client retention rates, average client lifecycle value, and lead conversion rates, firms can gain a clearer picture of their CRM’s impact. Regularly reviewing these metrics allows firms to continually optimize their CRM usage and ensure it remains a consistently cost-effective solution for independent financial planning firms.

Avoiding Common Pitfalls When Selecting a Cost-Effective CRM

Choosing a cost-effective CRM solution for independent financial planning firms is fraught with potential missteps if not approached strategically. One of the most common pitfalls is focusing solely on the lowest price tag without considering the true value and long-term suitability of the software. An overly cheap solution might lack critical features, provide inadequate support, or struggle with scalability, costing more in lost productivity and future upgrades. Another frequent mistake is failing to adequately assess your firm’s specific needs before beginning the search. Without a clear understanding of your core workflows, compliance requirements, and desired integrations, you risk selecting a CRM that either over-delivers on unnecessary features or under-delivers on essential ones. Furthermore, neglecting user adoption in the evaluation process can be detrimental. A powerful CRM is useless if your team doesn’t find it intuitive or if training is insufficient. Involving key team members in the selection process and prioritizing user-friendly interfaces can prevent a costly investment from becoming a shelfware statistic.

Real-World Impact: How Cost-Effective CRMs Empower Independent Advisors

Consider the fictional “Summit Wealth Management,” a rapidly growing independent financial planning firm. Initially, they relied on spreadsheets and disjointed tools, leading to missed follow-ups, inconsistent client data, and hours wasted on administrative tasks. After evaluating several cost-effective CRM solutions for independent financial planning firms, they implemented a cloud-based, industry-specific CRM. Within months, the transformation was evident. Client onboarding time was slashed by 40% due to automated workflows, freeing up advisors to focus on financial planning. Personalized client communication, driven by CRM insights into client preferences and life events, led to a 15% increase in client referrals within the first year. Regulatory audits became less stressful as the CRM provided an immutable audit trail of all client interactions and document approvals. The initial investment, while carefully considered, quickly proved its cost-effectiveness through increased operational efficiency, enhanced client loyalty, and a measurable boost in the firm’s overall profitability. Their experience underscores that the right CRM isn’t just about managing clients; it’s about fundamentally transforming how an independent firm operates and grows.

Emerging Trends in Cost-Effective CRM for Financial Services

The landscape of CRM technology is constantly evolving, bringing new innovations that further enhance the cost-effectiveness and capabilities for independent financial planning firms. One of the most significant emerging trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are starting to power features like predictive analytics for client behavior, automated lead scoring, and intelligent recommendations for next best actions, allowing advisors to be more proactive and efficient. Enhanced mobile accessibility is another crucial trend, enabling advisors to access critical client data and manage tasks on the go, improving responsiveness and flexibility. Furthermore, hyper-personalization, driven by deeper data insights and AI, is becoming more sophisticated, allowing firms to deliver an even more tailored client experience. While some of these advanced features might initially appear exclusive to high-end solutions, their integration into more budget-friendly platforms is making them increasingly accessible. Independent firms should keep an eye on these developments, as they promise to offer even greater efficiencies and competitive advantages, continuing to push the boundaries of what cost-effective CRM solutions for independent financial planning firms can achieve.

Empowering Your Independent Financial Planning Firm with the Right CRM

In conclusion, the journey to finding truly cost-effective CRM solutions for independent financial planning firms is not merely about minimizing expenditure; it is about maximizing value, efficiency, and client satisfaction. By meticulously evaluating options based on their core features, scalability, integration capabilities, data security, and long-term ROI, independent advisors can select a CRM that acts as a powerful catalyst for growth. The right system will streamline operations, automate tedious tasks, deepen client relationships, and ensure compliance, all while respecting the unique budgetary and operational realities of an independent practice. Embracing a well-chosen CRM is an investment not just in technology, but in the future resilience, profitability, and client-centricity of your independent financial planning firm. It empowers you to navigate the complexities of the financial world with greater confidence, focus on what you do best—providing exceptional financial guidance—and ultimately, build a thriving, sustainable business.