Introduction: The Independent Financial Planner’s Unique Challenges in a Complex World

Being an independent financial planner is a unique and often incredibly rewarding endeavor. You’re not just an expert in wealth management, investments, and financial strategy; you’re also the CEO, marketing director, operations manager, and IT support for your own thriving practice. This multi-faceted role, while offering unparalleled autonomy, also presents a cascade of challenges, particularly when it comes to managing the sheer volume of tasks, client communications, and regulatory obligations that demand your attention daily. The dream of spending more time advising clients and less time on administrative minutia often remains just that – a dream – without the right tools in place.

The modern financial landscape is characterized by increasing complexity, tighter regulations, and an ever-evolving client expectation for personalized, prompt, and proactive service. For independent financial planners, this means that every client interaction, every follow-up, every compliance check, and every strategic planning session needs to be meticulously tracked, executed, and documented. Without a robust system, the danger of oversights, missed opportunities, and administrative overload becomes a very real threat to both your practice’s efficiency and your clients’ satisfaction. This article delves into how simplifying task management with CRM for independent financial planners isn’t just a desirable outcome, but an absolute necessity for sustainable growth and peace of mind.

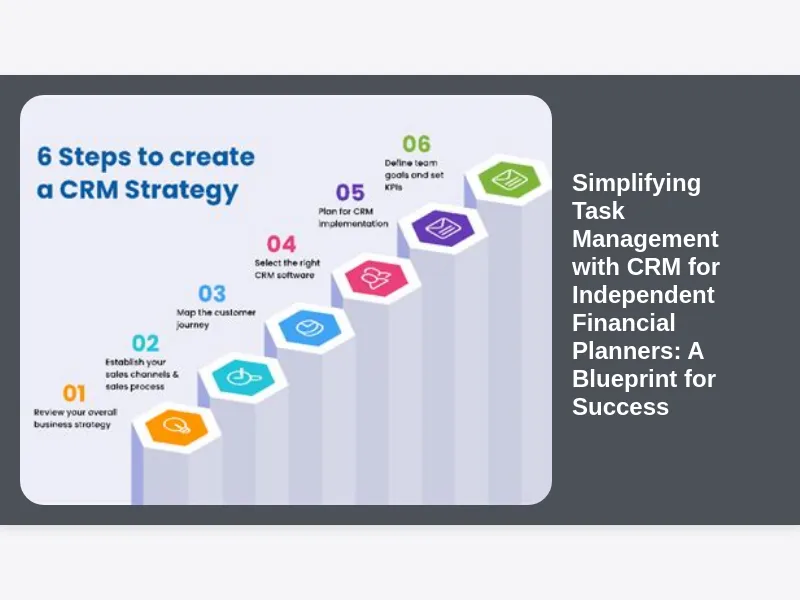

What Exactly is CRM, and Why Is It Indispensable for Financial Advisors?

At its core, CRM stands for Customer Relationship Management, and while the term might evoke images of large sales teams, its application extends far beyond mere sales tracking. For independent financial planners, a CRM system is a sophisticated software solution designed to help you manage and analyze customer interactions and data throughout the customer lifecycle, with the goal of improving business relationships with customers, assisting in customer retention, and driving sales growth. Think of it as your practice’s central nervous system, where all client-related information and activities reside.

However, for financial advisors, a CRM isn’t just about managing relationships; it’s about managing the entire client journey from prospect to long-term client, encompassing every touchpoint, document, and strategic decision. It tracks leads, manages client portfolios, schedules meetings, automates communication, and ensures compliance with industry regulations. The indispensable nature of a CRM for financial advisors lies in its ability to consolidate disparate information, automate repetitive tasks, and provide a holistic view of each client, thereby enabling a level of personalized service and operational efficiency that manual methods simply cannot match. It is the cornerstone for simplifying task management with CRM for independent financial planners by bringing order to what can often feel like chaos.

The Juggling Act: Task Management Woes for Solo Advisors

The daily life of an independent financial planner often feels like a constant juggling act. You’re simultaneously preparing for a client review, onboarding a new prospect, following up on a compliance document, researching market trends, and perhaps even trying to squeeze in some marketing efforts. Without a centralized system, these tasks are often managed through a patchwork of sticky notes, spreadsheets, calendar reminders, and email flags – a method that is inherently prone to error, inefficiency, and significant stress. The mental load of keeping track of everything can be exhausting, leaving less energy for the strategic, high-value work that truly drives your practice forward.

The common task management woes include missed follow-ups, forgotten deadlines, duplication of effort, and a lack of clear visibility into client status. Imagine trying to recall the last conversation you had with a specific client, the key points discussed, and the action items agreed upon, all while juggling dozens of other client files. This scattered approach not only consumes valuable time but also compromises the quality of your client service. Clients expect their financial planner to be organized and informed, and a disjointed task management system can undermine their confidence. This is precisely where the power of simplifying task management with CRM for independent financial planners comes into play, offering a cohesive platform to overcome these prevalent challenges.

Beyond Contact Management: CRM’s Role in Streamlining Operations for Financial Professionals

While contact management is a foundational element of any CRM, its true power for financial professionals extends far beyond simply storing names and numbers. Modern CRM solutions are comprehensive operational hubs designed to streamline virtually every aspect of a financial planning practice. They transform raw client data into actionable insights, automate routine processes, and provide the infrastructure for a truly organized and scalable business. This goes beyond just knowing who your clients are; it’s about understanding their financial goals, their risk tolerance, their family dynamics, and their preferred communication methods, all within a unified platform.

By centralizing information and automating workflows, a CRM becomes an indispensable tool for enhancing operational efficiency. For instance, it can manage the entire client lifecycle from initial inquiry to long-term relationship, including lead tracking, appointment scheduling, document management, and service request fulfillment. Furthermore, it often integrates with other critical tools like portfolio management software, financial planning tools, and compliance systems, creating a seamless ecosystem. This integration dramatically reduces manual data entry, minimizes errors, and ensures that all relevant information is always up-to-date and accessible. For independent financial planners striving for operational excellence, embracing a robust CRM is the most effective path toward simplifying task management with CRM for independent financial planners and achieving a truly streamlined practice.

Customizing Your Workflow: Tailoring CRM for Unique Financial Planning Needs

One of the most significant advantages of modern CRM systems, especially for independent financial planners, is their remarkable flexibility and customizability. Unlike off-the-shelf generic software, many CRMs designed for the financial services industry, or those that are highly configurable, allow you to tailor workflows, fields, and processes to perfectly match the unique way you run your practice and serve your clients. This isn’t a one-size-fits-all solution; it’s about creating a digital environment that mirrors your specific operational model, your client segmentation strategies, and your preferred service delivery methods.

Imagine being able to design custom onboarding workflows that automatically trigger specific tasks, document requests, and welcome emails at each stage of a new client’s journey. Or setting up distinct service models for different client tiers, ensuring that your high-net-worth clients receive a more frequent and tailored communication schedule, all automated within the system. This level of customization ensures that the CRM isn’t just a repository of data but an active participant in your practice’s daily operations, enforcing consistency and maximizing efficiency. Tailoring your CRM to your unique needs is critical for truly simplifying task management with CRM for independent financial planners, allowing the technology to adapt to you, rather than forcing you to adapt to the technology.

Client Onboarding Made Simple: A Smoother Start with CRM Automation

The client onboarding process can often be one of the most time-consuming and administratively heavy aspects of an independent financial planner’s practice. From initial contact and data gathering to risk assessments, document signing, account opening, and setting up initial meetings, there are numerous steps that require meticulous attention. A fragmented approach can lead to delays, frustration for both you and the client, and even compliance risks if documents or disclosures are missed. This is where a CRM truly shines, transforming a potentially cumbersome process into a smooth, efficient, and professional experience.

By leveraging CRM automation, you can create standardized onboarding workflows that guide you and your new client through each step systematically. The system can automatically generate a checklist of required documents, send out welcome emails with links to client portals, schedule introductory calls, and set reminders for follow-up actions. This not only significantly reduces the administrative burden on your end but also provides a superior experience for the client, who perceives a highly organized and professional practice. A streamlined onboarding process, powered by CRM, sets the stage for a positive long-term relationship and is a prime example of simplifying task management with CRM for independent financial planners right from the very beginning.

Automating Follow-ups and Reminders: Never Miss a Beat with Clients

In the fast-paced world of financial planning, the ability to consistently follow up with clients and prospects is paramount to building trust and nurturing relationships. However, manually tracking every promise made, every question asked, and every next step can be an overwhelming endeavor, especially as your client base grows. Missed follow-ups can lead to lost opportunities, client dissatisfaction, and the erosion of credibility. This is precisely where the automation capabilities of a CRM become invaluable, ensuring that no client interaction or critical reminder ever falls through the cracks.

A well-configured CRM allows you to set up automated reminders for a vast array of tasks: annual review meetings, birthday wishes, portfolio rebalancing alerts, follow-ups after specific market events, or even just check-in calls. These reminders can be triggered based on specific dates, client segments, or predefined workflows, ensuring timely and relevant communication. Furthermore, the CRM can automate the sending of personalized emails, newsletters, or educational content, keeping your clients engaged and informed without requiring constant manual effort. This proactive approach to client engagement, driven by automation, ensures that you’re always one step ahead, demonstrating consistent care and attention. This seamless process of automating communication and ensuring timely interactions is a cornerstone of simplifying task management with CRM for independent financial planners.

Compliance and Record-Keeping: Meeting Regulatory Standards Effortlessly

For independent financial planners, compliance is not merely a suggestion; it’s a non-negotiable cornerstone of their practice. The financial industry is heavily regulated, with strict requirements for record-keeping, client communication, disclosure, and data privacy. Failing to meet these standards can result in severe penalties, reputational damage, and even the loss of your license. Manually managing compliance records and ensuring that every interaction adheres to regulatory guidelines can be an arduous and error-prone process, consuming an inordinate amount of time and resources.

A specialized CRM designed for financial services, or one with robust customization options, plays a pivotal role in simplifying compliance management. It provides a centralized, secure repository for all client-related documentation, communications, and activity logs. Every email, phone call, meeting note, and document exchange can be automatically logged and time-stamped, creating an auditable trail that is essential for regulatory reviews. Furthermore, many CRMs offer features like audit logs, version control for documents, and the ability to set up mandatory fields and workflows to ensure that all necessary disclosures are made and consent obtained. This systematic approach not only reduces the risk of non-compliance but also provides peace of mind, knowing that your practice is always prepared for regulatory scrutiny. This robust record-keeping and process enforcement are vital elements in simplifying task management with CRM for independent financial planners within a highly regulated environment.

Integrating Your Tech Stack: CRM as the Central Hub for Financial Tools

The modern independent financial planner often utilizes a diverse array of specialized software tools, each designed to optimize a specific aspect of their practice. This might include portfolio management systems, financial planning software, risk assessment tools, document management solutions, email marketing platforms, and accounting software. While each tool offers unique benefits, a common challenge arises when these systems operate in silos, leading to fragmented data, duplicate entry, and inefficient workflows. The true power of a CRM emerges when it acts as the central hub, integrating seamlessly with your entire tech stack.

When your CRM is integrated with other critical applications, data flows effortlessly between systems, eliminating manual data transfer and ensuring consistency across all platforms. For example, client data entered into the CRM can automatically populate your financial planning software, or investment recommendations from your portfolio management system can be instantly reflected in client profiles within the CRM. This interconnected ecosystem not only saves an immense amount of time and reduces the potential for errors but also provides a holistic and up-to-date view of each client’s financial picture from a single interface. By establishing your CRM as the central nervous system of your digital infrastructure, you unlock unprecedented levels of efficiency and coherence. This strategic integration is key to simplifying task management with CRM for independent financial planners by consolidating all operational touchpoints.

Boosting Productivity and Efficiency: More Time for Strategic Planning

One of the most tangible and immediate benefits of implementing a robust CRM for independent financial planners is the significant boost in overall productivity and efficiency. By automating repetitive administrative tasks, centralizing client information, and streamlining communication workflows, a CRM frees up an incredible amount of time that was previously consumed by mundane, non-revenue-generating activities. This reclaimed time isn’t just about working fewer hours; it’s about reallocating your most valuable resource – your time and mental energy – to strategic activities that truly move your practice forward.

Imagine being able to dedicate more hours to in-depth financial analysis, developing complex investment strategies, proactively identifying new client needs, or even exploring new market opportunities. With a CRM handling the bulk of your task management and administrative burdens, you gain the capacity to engage in higher-level thinking and proactive planning. This shift from reactive administration to proactive strategy not only enhances the quality of service you provide to your existing clients but also creates fertile ground for growth and innovation within your practice. Ultimately, the goal of simplifying task management with CRM for independent financial planners is to empower you to be a more effective advisor and a more strategic business owner.

Measuring Success: Tracking Performance and Client Engagement Metrics

In any business, “what gets measured gets managed.” For independent financial planners, understanding the performance of your practice and the level of engagement with your clients is crucial for making informed decisions and driving continuous improvement. Without a systematic way to track key metrics, you’re essentially operating in the dark, unable to accurately assess what’s working, what’s not, and where opportunities for growth lie. A well-configured CRM provides the analytical tools and reporting capabilities necessary to bring clarity to these vital areas.

Modern CRM systems offer dashboards and reporting features that can track a wide array of performance indicators. You can monitor lead conversion rates, client retention percentages, the frequency and nature of client interactions, service delivery timelines, and even the profitability of different client segments. By analyzing client engagement metrics, you can identify patterns, tailor your communication strategies, and proactively address potential issues before they escalate. This data-driven approach allows you to optimize your workflows, refine your marketing efforts, and ultimately enhance client satisfaction and loyalty. The ability to measure and analyze these critical aspects is an integral part of simplifying task management with CRM for independent financial planners as it transforms anecdotal observations into actionable intelligence.

Overcoming Implementation Hurdles: Best Practices for Adopting CRM

The prospect of adopting a new CRM system can sometimes feel daunting, especially for independent financial planners who are already stretched for time. Concerns about data migration, learning curves, potential disruptions to existing workflows, and the initial investment cost are common and valid. However, with a strategic approach and adherence to best practices, these implementation hurdles can be effectively overcome, paving the way for a successful transition and long-term benefits. The key is to view CRM implementation not as a one-time IT project, but as an ongoing process of optimizing your practice.

One crucial best practice is to start small and scale up. Don’t try to implement every feature and customize every workflow on day one. Prioritize the most critical functions that will yield the quickest wins, such as contact management and basic task tracking, and gradually introduce more advanced features as your comfort level grows. Thorough data cleansing and migration planning are also essential to ensure the integrity of your information. Furthermore, adequate training for yourself and any support staff, coupled with ongoing support from the CRM vendor or a consultant, will significantly smooth the learning curve. Embracing a phased approach and focusing on user adoption are fundamental to successfully simplifying task management with CRM for independent financial planners without overwhelming your operations.

Choosing the Right CRM: Key Considerations for Independent Financial Planners

Selecting the right CRM solution is a critical decision that will impact the efficiency and growth of your independent financial planning practice for years to come. With a multitude of options available, ranging from generic business CRMs to highly specialized platforms for financial services, making an informed choice requires careful consideration of your specific needs, budget, and long-term goals. A hasty decision can lead to buyer’s remorse, underutilization, and the need for another costly transition down the line.

Key considerations should include the CRM’s industry-specific features – does it understand the nuances of financial planning, compliance, and client relationships in your sector? Integration capabilities are paramount; ensure it can connect seamlessly with your existing tech stack, such as portfolio management and financial planning software. Scalability is another vital factor; choose a CRM that can grow with your practice, accommodating an increasing client base and evolving service offerings. User-friendliness, robust security features, reliable customer support, and a transparent pricing model are also non-negotiable elements. Taking the time to research, demo multiple options, and speak with other independent planners about their experiences will be invaluable in making a choice that truly contributes to simplifying task management with CRM for independent financial planners.

Future-Proofing Your Practice: Scalability with CRM Solutions

In the dynamic world of financial services, the ability to adapt and grow is paramount for long-term success. For independent financial planners, future-proofing your practice means building an infrastructure that can not only handle your current client load but also accommodate significant expansion without causing operational bottlenecks. This is where the inherent scalability of robust CRM solutions truly shines, providing a solid foundation for sustainable growth.

A well-chosen CRM system is designed to scale with your business. As your client base expands, the CRM can effortlessly manage an increasing volume of client data, interactions, and tasks. It allows you to standardize processes, making it easier to onboard new clients efficiently and consistently deliver high-quality service, even with a larger caseload. Should you decide to hire additional staff or expand your service offerings, the CRM provides a centralized platform for collaborative work and ensures that new team members can quickly get up to speed on client histories and ongoing tasks. Investing in a scalable CRM is an investment in the long-term viability and growth of your practice, ensuring that you’re well-equipped to navigate future challenges and opportunities. This foresight in choosing a scalable solution is crucial for effectively simplifying task management with CRM for independent financial planners as your business evolves.

Real-World Impact: Testimonials and Case Studies (Simulated)

The theoretical benefits of CRM are compelling, but its true value is best understood through the experiences of independent financial planners who have successfully integrated it into their practices. While I cannot provide actual live testimonials, let’s imagine a few scenarios that reflect the transformative impact of CRM. Consider “Sarah,” an independent advisor who was overwhelmed by manual spreadsheets and missed follow-ups. After implementing a specialized CRM, she found she could onboard new clients 30% faster and consistently follow up on every action item, leading to a 20% increase in client referrals within the first year. Her clients noticed the difference, commenting on her increased responsiveness and proactive communication.

Then there’s “Mark,” who struggled with compliance documentation. His CRM’s automated audit trails and document management features meant he passed his last regulatory audit with flying colors, significantly reducing his stress levels and giving him more confidence in his practice’s operations. These imagined scenarios underscore a common theme: independent financial planners who embrace CRM don’t just become more organized; they become more effective, more competitive, and ultimately, more successful. The tangible improvements in client service, operational efficiency, and peace of mind demonstrate that simplifying task management with CRM for independent financial planners is a proven strategy for real-world business success.

FAQs about CRM for Financial Advisors: Addressing Common Concerns

Many independent financial planners often have similar questions when considering a CRM. Let’s address some of the most common ones.

Q: Is CRM really necessary for a small, independent practice? Can’t I just use spreadsheets and my calendar?

A: While spreadsheets and calendars can suffice for very small practices with limited clients, they quickly become unmanageable as you grow. A CRM provides a centralized, automated, and secure system that eliminates manual errors, ensures compliance, and allows you to scale efficiently. It’s about moving from reactive management to proactive strategy, ultimately saving you time and enhancing client service in the long run. The benefits of simplifying task management with CRM for independent financial planners far outweigh the initial effort.

Q: How long does it typically take to implement a CRM, and what’s the learning curve like?

A: Implementation time varies greatly depending on the complexity of the CRM, the amount of data migration required, and your desired level of customization. A basic setup can take a few weeks, while a fully customized and integrated solution might take a few months. The learning curve also depends on the CRM’s user-friendliness and your prior experience with similar software. Most reputable vendors offer training and support to help ease the transition, and a phased approach can make it less overwhelming.

Q: What about data security and privacy? How can I ensure my clients’ sensitive financial information is safe in a CRM?

A: Data security is paramount for financial advisors. When choosing a CRM, prioritize vendors that offer robust security features, including encryption, multi-factor authentication, regular backups, and compliance with industry-specific regulations (e.g., FINRA, SEC, GDPR where applicable). Ask about their data centers, disaster recovery plans, and privacy policies. Many CRMs designed for financial services are built with these stringent security requirements in mind.

Q: Is a specialized financial advisor CRM always better than a general CRM that I can customize?

A: Not necessarily. Specialized CRMs often come with built-in features and compliance templates specifically for financial services, which can save time on setup. However, highly customizable general CRMs can be tailored to your exact needs, potentially offering more flexibility if your practice has very unique requirements. The best choice depends on your specific budget, technical comfort level, and the complexity of your desired workflows. Both options contribute to simplifying task management with CRM for independent financial planners but through different paths.

The Bottom Line: Transforming Your Practice with CRM for Independent Financial Planners

For independent financial planners navigating the complexities of modern wealth management, the journey towards greater efficiency, enhanced client satisfaction, and sustainable growth often hinges on one critical decision: embracing a robust CRM solution. The daily demands of managing client relationships, adhering to stringent compliance regulations, and executing intricate financial strategies can quickly overwhelm even the most organized advisor when relying on outdated, manual methods. A CRM, however, acts as a transformative force, centralizing every piece of client information, automating repetitive administrative burdens, and providing the clear visibility needed to make informed decisions.

By simplifying task management with CRM for independent financial planners, you are not just investing in software; you are investing in the future of your practice. You are reclaiming valuable time that can be redirected towards strategic planning, deepening client relationships, and exploring new avenues for growth. The ability to streamline client onboarding, automate follow-ups, ensure meticulous compliance, and integrate seamlessly with your existing tech stack provides an unparalleled competitive advantage. Ultimately, a well-implemented CRM empowers independent financial planners to move beyond simply managing their practice to truly mastering it, fostering a more productive, compliant, and client-centric business that is built for long-term success. It’s time to transform your operational challenges into opportunities for excellence.